Corporate Cards

Global Coverage

Physical and virtual cards

Secure spending, fraud monitoring

Issue cards instantly

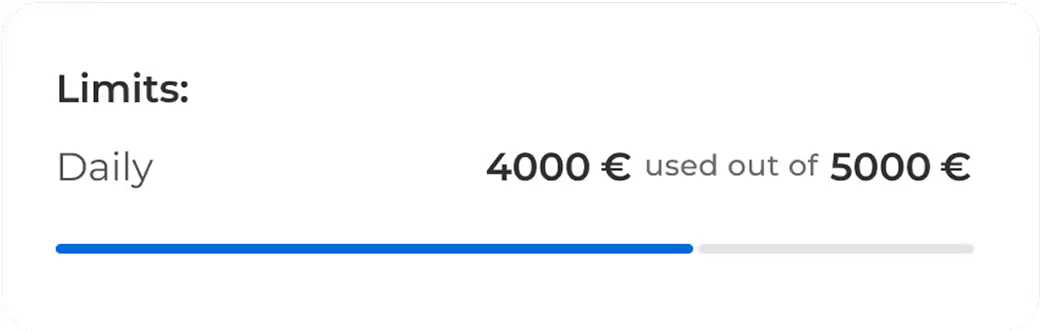

10-20X higher spending limits

Issue physical and virtual cards, instantly

Issue physical and virtual cards on demand, allowing your team to start spending immediately without delays. Perfect for fast-growing startups needing immediate purchasing power.

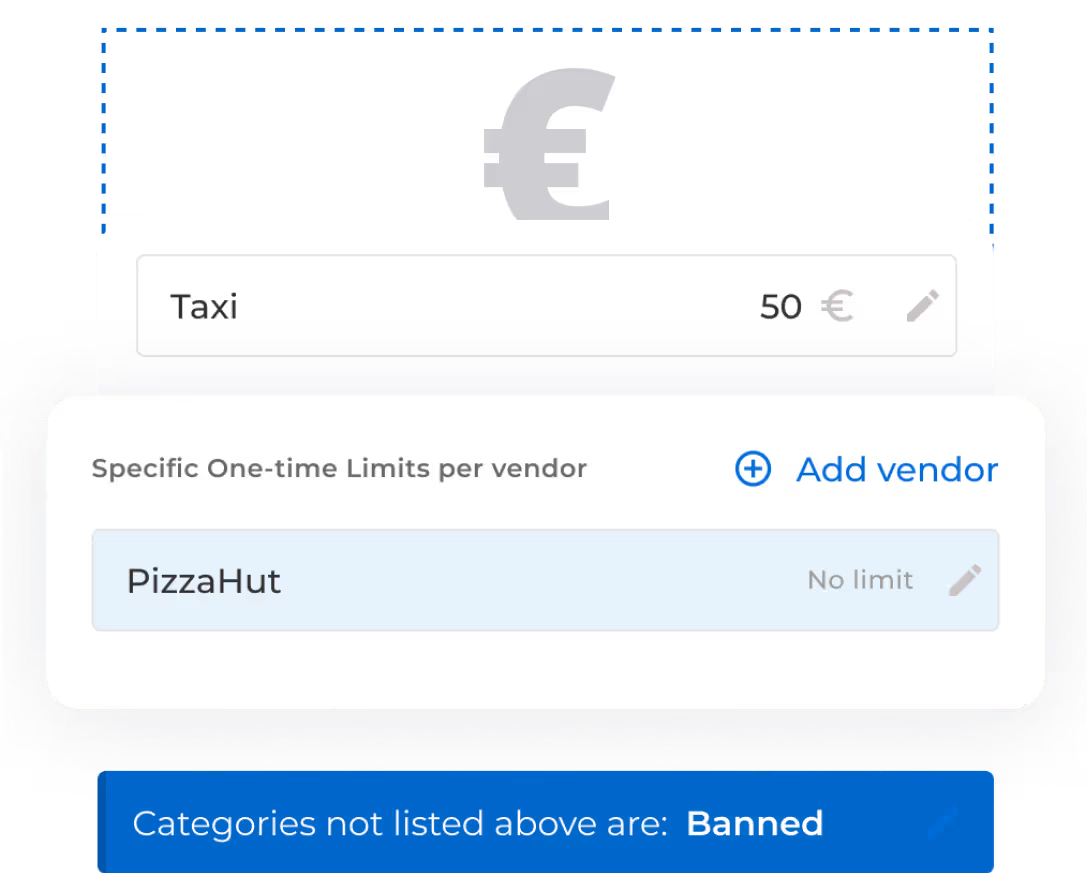

Get built-in controls into each card

Empower your team with freedom while maintaining control. Set custom limits and spending rules directly on each card to align with budgets. Track spending in real-time and adjust controls instantly, ensuring every expense matches your financial strategy.

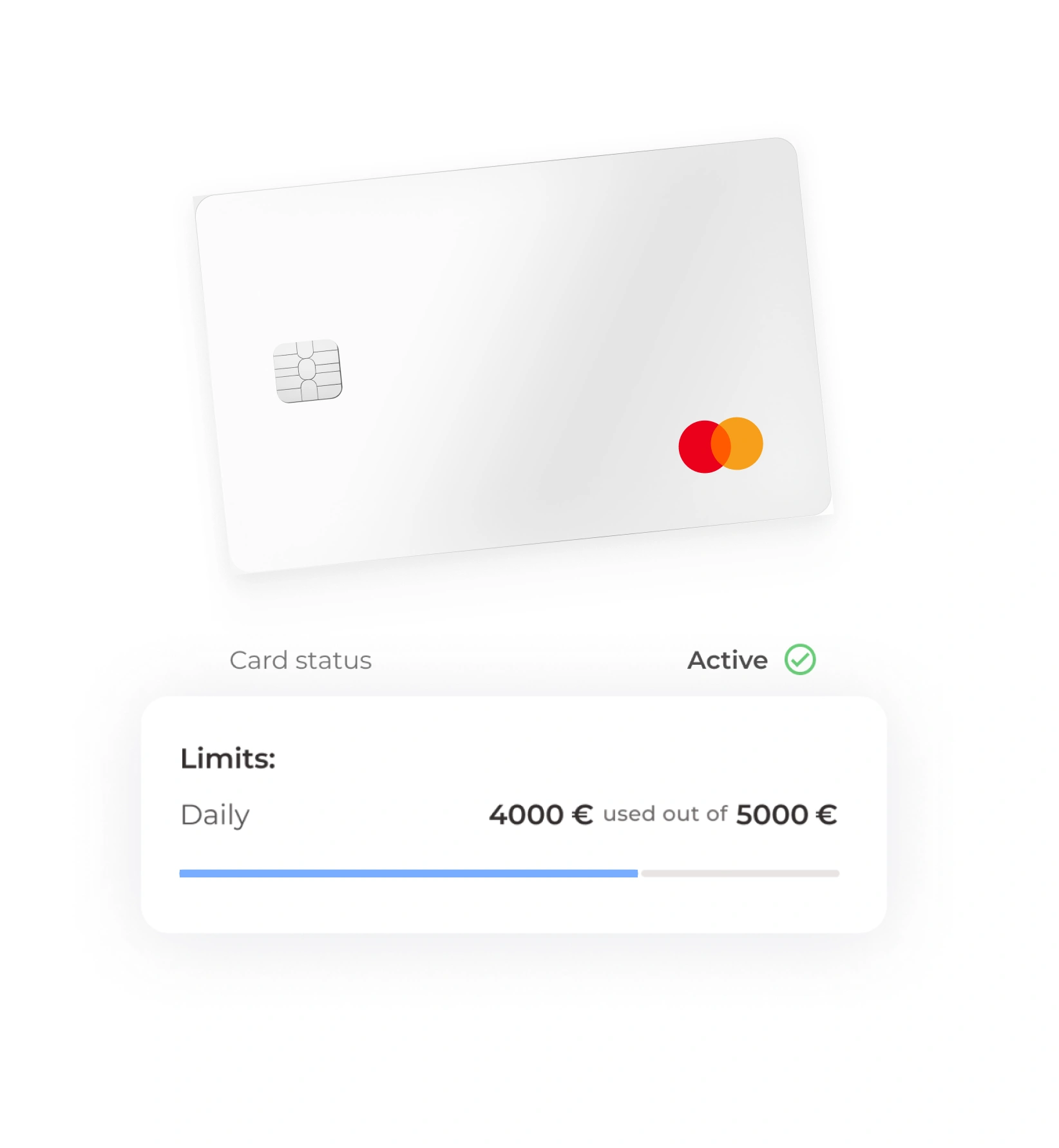

Get spending limits that fuel your growth

Unlock spending power that grows with you, offering up to 10-20X higher limits than traditional cards. Husk's robust limits let you scale operations confidently, providing the flexibility to meet your startup’s evolving needs.

Enhance global spending

Use our corporate cards to spend confidently worldwide. Powered by the Mastercard network, our cards are accepted at millions of locations globally, ensuring your team enjoys reliable spending capabilities wherever business takes them.

FAQ

What are Husk corporate cards?

Husk offers corporate charge cards for your business expenses. You have up to 30 days to repay charges, with the exact repayment date shown in your dashboard. You can spend up to your assigned credit limit during this period.Husk provides both virtual and physical cards, which run on the Mastercard network for worldwide acceptance.The cards are issued under an EMI-license granted to our partner Stripe by the Bank of Ireland.Our cards provide your company with better control over spending while ensuring liquidity remains stable.

What are virtual cards?

Virtual cards are secure corporate cards designed for online payments. You can create them instantly through our platform and use them right away. They function exactly like physical cards.

What are the spending limits on my card?

Husk provides a company-wide credit limit, which represents the maximum amount that can be spent across all cards during the payment period. You can also set individual spending limits for specific members and cards.

For example, if your company limit is €10,000 per month, you could set a specific card limit of €2,000 per month. At Husk, you can customize your card program by setting limits based on categories, countries, and amounts to match your needs.We have a maximum transaction limit of €10,000 per transaction. If you need higher limits, please contact us—we'll evaluate these requests individually.

Do I need to top up the corporate cards to use Husk?

No, you don't need to top up or wire money to use a Husk corporate card. This sets us apart from prepaid or debit card providers. You maintain complete cash flexibility and agility. There's no need to transfer funds or open additional bank accounts. Simply connect our platform to your existing banking partners.

What is my PIN code and how can I change that?

You can set your own PIN code. Husk cannot set it for you and has no access to view it. To set or change your PIN, go to the dashboard, select your physical card, and enter the new PIN code. Changes take effect immediately.

Husk is supported by

.png)

Get started with husk

Experience how Husk can transform your financial workflows from day one.